new jersey tax

4 weeks or more after you file electronically. First there are New Jerseys Urban Enterprise Zones where purchases made at qualified.

|

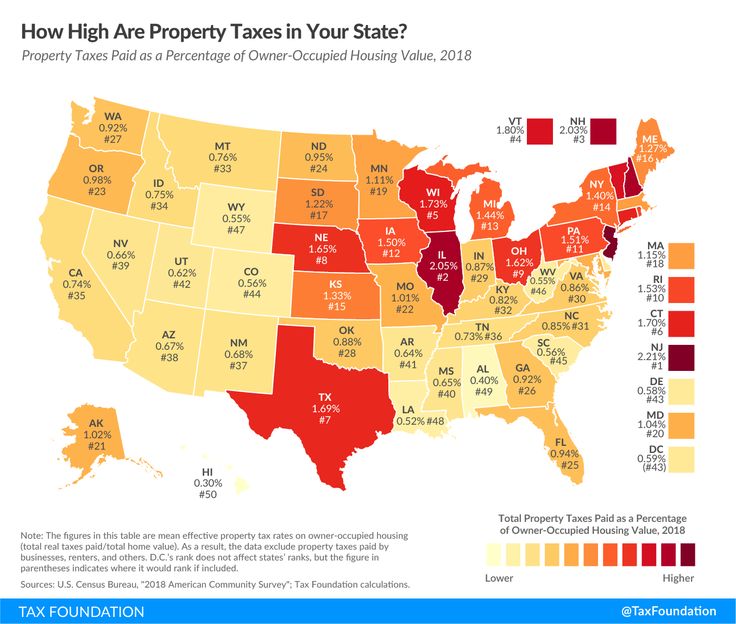

| States With The Highest And Lowest Property Taxes Property Tax Tax States |

Check Your Refund Status.

. New Jersey Sales and Use Tax Energy Return. Sales Tax Collection Schedule 7 ended on 12312016. You must display this document in your place of business. License and Business Verification.

Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281. E-File Directly to the IRS State. Your New Jersey Tax ID number will be the same as your EIN number plus a 3-digit suffix and is used for state tax purposes. Application for Extension of Time to File Income Tax Return.

Business Registration and Information Services. By Mail - Check or money order payable to. Unlike the Federal Income Tax New Jerseys state income tax does not provide couples filing jointly with expanded income tax brackets. 5 will waive New Jerseys 6625 sales tax on a range of supplies including pens notebooks art supplies text books computers and sports.

E-File Directly to New Jersey for only 1499. Stay up to date on vaccine information. The rate of sales tax in New Jersey is 6625 percent ranking eighth in the country according to the Tax Foundation. Your BRC will include a control number used only to verify that your certificate is current.

Select A Year. Tax due for the third month of the quarter is. New Jerseys tax system ranks 50th overall on our 2022 State Business Tax Climate Index. At least 12 weeks after you mail your return.

Show Alerts COVID-19 is still active. Sales tax holiday on school supplies starts this weekend. Tax information for individuals living in New Jersey. Sales Tax Collection Schedule 6875 effective 01012017 through 12312017.

Division of Taxation PO Box 281 Trenton NJ 08695-0281. When can you start checking your refund status. State of New Jersey Government NJ Taxes. New Jersey collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Pay Senior Freeze Property Tax Reimbursement bills. Checking Account Debit - Download complete and send the automated clearing house ACH Payment Authorization Form to the above address or. Resident Income Tax Return Payment Voucher. 2016 and prior.

Sign Purchases and Installation Services Sales and Use Tax Effective October 1 2022. If you completed your application online you will be issued a. Pay Homestead Benefit bills. Sales and Use Tax.

Ad E-File Free Directly to the IRS. The State of NJ site may contain optional links information services andor content from other websites operated by third parties that are provided as a convenience such as Google Translate. 15 weeks or more for additional processing requirements or paper returns sent by certified mail. New Jersey assesses a 6625 Sales Tax on sales of most tangible personal property specified digital products and certain services unless specifically exempt under New Jersey law.

Estimated Income Tax Payment Instructions. If your notice directs you to choose Option B to make a payment. Order NJ Tax Forms. Where Is my Refund.

New Jersey has a 6625 percent state sales tax rate a max local sales tax rate of 3313 percent and an average combined state and local sales tax rate of 660 percent. Watch as the NJ Spotlight News team breaks down todays top stories. In Person - The Tax Collectors office is open 830 am. 280 Grove St Rm 101.

We bring you whats relevant and important in New Jersey news along with our insight. Drought worsens in NJ more areas added to. The flat sales tax rate means you will pay the same rate wherever you are in the state with two exceptions. Each states tax code is a multifaceted system with many moving parts and New.

Income Tax Refund Status. New Jersey sales tax rate. Businesses and higher-income families will benefit most some tax experts say. Call NJPIES Call.

Business Taxes and Fees. City of Jersey City Tax Collector. New Jersey Sales Tax. Free 2021 Federal Tax Return.

Sales and Use Tax. Employers use the Form NJ-500 Monthly Remittance of Gross Income Tax Withheld to remit tax for either of the first two months of a quarter whenever the amount due for either month is 500 or more. 1 2018 that rate decreased from 6875 to 6625. Form NJ-500 is due on or before the 15th day of the month following the end of the reporting period.

Estimated Income Tax Payment Voucher for 2022. First time paper filers are required to mail in a payment. The tax holiday which runs from Aug. New Jerseys maximum marginal income tax rate is the 1st highest in the United States ranking directly below New Jerseys.

Electronic Funds Transfer EFT Gross Income Tax Individual Inheritance and Estate Tax. You can choose to pay by check or money order instead of electronically. New Jersey has a single statewide sales tax rate. Call 1-800-323-4400 toll-free within NJ NY PA DE and MD.

|

| New Jersey State Income Tax Form Tax Forms Post Office Income Tax |

|

| Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax |

|

| Looking For A Nj Tax Forms And Templates Download It For Free |

|

| New Jersey Has The Highest Effective Rate On Owner Occupied Property At 2 21 Percent Followed Closely By Illinois 2 05 Percent And N Property Tax Tax States |

|

| New Jersey New Jersey Jersey Student Loan Forgiveness |

Posting Komentar untuk "new jersey tax"